Bitcoin Price Prediction: Technical Consolidation Meets Bullish Fundamentals

#BTC

- Bitcoin is consolidating below the 20-day moving average at $92,696, with technical indicators suggesting potential for upward movement toward $100,000

- Major institutional developments including Nasdaq's proposed 40-fold increase in Bitcoin ETF options and Wall Street's derivatives shift provide strong fundamental support

- Market sentiment remains bullish despite near-term technical resistance, driven by predictions of $250,000 targets and growing mainstream adoption

BTC Price Prediction

Technical Analysis: Bitcoin Trading Below Key Moving Average

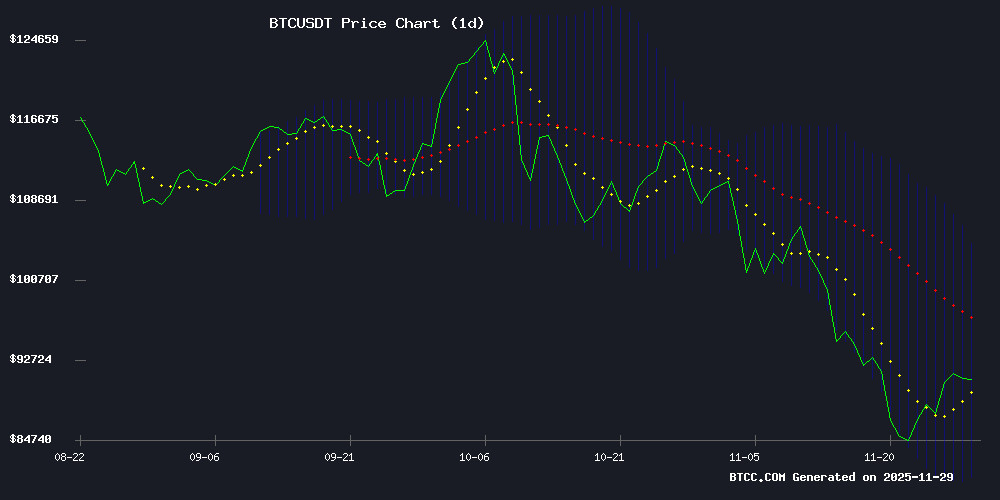

Bitcoin is currently trading at $90,606.33, positioned below the 20-day moving average of $92,696.38, indicating potential short-term resistance. The MACD reading of -885.84 shows bearish momentum in the immediate term. However, Bitcoin remains within the Bollinger Band range of $81,003.16 to $104,389.61, with the current price sitting closer to the middle band, suggesting consolidation. According to BTCC financial analyst William, 'The technical setup shows Bitcoin is in a consolidation phase after recent volatility. The key resistance lies at the 20-day MA around $92,700, while support holds strong near $81,000.'

Market Sentiment: Institutional Developments Drive Optimism

Multiple positive catalysts are emerging across the cryptocurrency landscape. BitMEX founder Arthur Hayes' prediction of Bitcoin reaching $250,000, combined with Nasdaq's proposal to significantly expand Bitcoin ETF options trading and Wall Street's pivot to perpetual contracts, creates a fundamentally bullish backdrop. BTCC financial analyst William notes, 'The institutional developments we're seeing - from expanded ETF options to major corporate Bitcoin movements - suggest growing mainstream acceptance. While Tether's shift to gold and whale movements to exchanges create some near-term uncertainty, the overall institutional narrative remains strongly positive for Bitcoin's long-term trajectory.'

Factors Influencing BTC's Price

BitMEX Founder Arthur Hayes Predicts Bitcoin Price Surge to $250K

BitMEX co-founder Arthur Hayes remains bullish on Bitcoin, forecasting a potential rise to $250,000 by 2025. He cites a market bottom at $80,600, ETF inflows, and expanding USD liquidity as key catalysts. Bitcoin has already rebounded 12% from its recent low, trading above $92,000.

The October leverage washout, which wiped billions from the crypto market, served as a reset. Historical patterns suggest such deleveraging phases often precede rapid 2-3x gains within months. Institutional activity through BlackRock's iShares bitcoin ETF (IBIT) has surpassed $20 billion in inflows, though much of this was tied to basis trades.

With major players like Goldman Sachs unwinding $523 million in short positions, the stage is set for organic demand to drive prices higher. The market appears poised for its next upward leg.

Japan Revisits Crypto Regulation Amid Rising Complaints and Tax Reform Debates

Japan's Financial Services Agency (FSA) convened its sixth working group meeting to address mounting consumer complaints, overseas fraud schemes, and cyber threats targeting crypto assets. With approximately 350 monthly complaints, regulators are considering a shift from the Payment Services Act to the Financial Instruments and Exchange Act—a move that would impose stricter disclosure rules and criminal penalties for misconduct.

The working group proposed aligning crypto taxation with equities, suggesting a flat 20% capital gains rate instead of the current 15-55% miscellaneous income brackets. Tatsuo Oku of the Blockchain Promotion Association noted Japan's 13 million crypto accounts could grow further with tax parity. Rintaro Kawai, CEO of ANAP Holdings, warned that Japan risks falling behind in global Bitcoin adoption without bold reforms.

Shinshu University's Professor Yoshikazu Yamaoki highlighted unresolved classification challenges, underscoring the sector's identity crisis as regulators balance innovation with investor protection.

SpaceX Moves $105 Million in Bitcoin Amid Market Speculation

Elon Musk's SpaceX has transferred 1,163 BTC, valued at approximately $105 million, to a new wallet, sparking debate over whether the aerospace firm is repositioning its holdings or preparing to sell. The transaction, detected by Arkham Intelligence on November 27, originated from a long-dormant treasury wallet and coincided with Bitcoin's rebound to $91,000.

Market observers note the absence of direct exchange links in the transfer, suggesting internal restructuring rather than imminent liquidation. A similar movement of 281 BTC in late October saw no subsequent sell-off, reinforcing the possibility of portfolio management rather than bearish intent.

Wall Street's Pivot to Perpetual Contracts Marks Decade's Biggest Derivatives Shift

Arthur Hayes, co-founder of BitMEX, asserts that Wall Street's embrace of perpetual contracts represents the most significant derivatives evolution in ten years. Singapore Exchange (SGX) and CBOE Global Markets plan to launch perpetual-style products by late 2025, while Coinbase has already introduced a retail version in the U.S. market this year.

The CFTC's proposed regulatory sandbox could soon enable new entrants to challenge CME Group's dominance. This marks a notable shift for the agency, which previously focused on crypto enforcement but now claims to foster financial innovation.

Perpetual contracts have created an 'adapt or die' moment for traditional finance, with global derivatives volume increasingly shifting from dated futures and options to non-expiring instruments. Hyperliquid's Nasdaq-100 equity perpetual, built on its HIP-3 protocol, already exceeds $100 million in daily trading volume.

Hayes predicts equity perpetuals will become 2026's most sought-after product, with all major centralized and decentralized exchanges offering them by next year. The transformation recalls BitMEX's early days in 2016 when it pioneered crypto perpetuals against dominant players OKCoin and Huobi.

Bitcoin Rebounds to $87K Amid Fed Rate Cut Speculation; Altcoins Gain Attention

Bitcoin surged past $87,000 as markets priced in potential Federal Reserve rate cuts, with CME FedWatch data showing a 67% probability of a 25bps reduction in December. The rally reflects renewed institutional confidence after BTC tested $81,000 support levels earlier this month.

Divisions within the Fed have emerged, with officials like Bowman and Waller advocating for easing while others urge caution. Treasury Secretary Scott Bessent's dismissal of recession fears has further bolstered risk assets.

Investors are rotating into nascent DeFi projects with high-growth potential, including Mutuum Finance (MUTM). The altcoin market shows signs of awakening as BTC dominance stabilizes, though no other specific coins were mentioned in this segment.

Tech Outage Halts Trading as Markets Eye Black Friday Retail Surge

Futures pointed higher before a data center cooling issue forced CME Group to halt trading across key markets. The outage froze Nasdaq futures at +0.2%, with S&P and Dow futures edging 0.1% higher in pre-holiday thin liquidity.

Bitcoin holds at $91,400 after breaking $90,000 midweek, signaling sustained institutional interest despite traditional market turbulence. Gold's push to $4,221/oz and oil at $59.08/barrel suggest inflationary pressures persisting into Q4.

Retail stocks lead pre-market gains as Black Friday sales commence. The SEC's probe into Jefferies over First Brands Group exposure adds to financial sector volatility.

Bitcoin Whale Inflows to Binance Hit Record $7.5B Amid Market Uncertainty

Bitcoin faces mounting pressure as whale deposits to Binance surge to a record $7.5 billion over the past 30 days, according to CryptoQuant data. The inflows, the highest ever recorded in a calendar year, mirror patterns seen in March 2025 when BTC plummeted from $102,000 to $70,000.

Analyst Maartunn notes whales typically transfer funds to exchanges for profit-taking or risk management during market weakness. With inflows still climbing, selling pressure shows no signs of stabilization. CryptoQuant CEO Ki Young Ju observes the November downturn resembles 2021's bear market more than 2023's minor correction.

Investors remain cautious as Bitcoin's risk zone persists. The market's fragility leaves open questions about trend reversal or further declines. Commodities expert G. Martín suggests October's $126,000 peak may have marked a local top.

Tether Shifts Focus to Gold, Pauses Bitcoin Purchases Amid Commodity Market Expansion

Tether, the issuer of USDT, has emerged as a dominant force in both crypto and commodity markets. The firm's Gold reserves now rival those of smaller central banks, with 116 tons acquired this year alone—equivalent to 2% of global gold demand last quarter.

CEO Paolo Ardoino's strategy positions gold as an inflation hedge, surpassing Tether's Bitcoin holdings. The MOVE reflects institutional confidence in precious metals despite the company's crypto roots. Financial Times reports highlight Tether's outsized influence, with purchases matching 12% of central bank gold acquisitions.

Nasdaq Proposes 1M Contract Limit for BlackRock's Bitcoin ETF Options

Nasdaq ISE has submitted a rule filing to the SEC seeking to increase position limits for BlackRock's iShares Bitcoin Trust (IBIT) options from 250,000 to 1,000,000 contracts. The exchange also plans to eliminate position limits entirely for physically settled FLEX IBIT options, catering to institutional demand.

The proposed adjustment follows a previous limit increase from 25,000 to 250,000 contracts in July. Bloomberg ETF analyst Eric Balchunas noted IBIT now dominates Bitcoin options markets by open interest. The rapid escalation suggests institutional activity is testing current constraints—exchanges typically only raise limits when existing caps impede genuine trading demand.

This development signals accelerating institutional adoption of Bitcoin through regulated vehicles. The trust's options market growth reflects deepening liquidity and maturing infrastructure for crypto derivatives in traditional finance frameworks.

Bitcoin Reclaims $90K as Traders Bet on $100K Year-End Target

Bitcoin surged past $90,000, marking a 13% rebound from recent lows, as Kalshi traders priced in a 60% chance of the cryptocurrency hitting $100,000 by December. The rally gained traction amid speculation that former President Trump could announce his Federal Reserve chair nominee before Christmas, with markets anticipating an 85% probability of a December rate cut.

Fed Chair Jerome Powell's term expires in May, and expectations of a dovish successor have fueled bets on earlier or deeper rate cuts. This sentiment has lifted risk assets across the board, from equities to cryptocurrencies. Treasury Secretary Scott Bessent noted five strong candidates are advancing in second-round interviews, adding to market optimism.

Despite the recovery, macro risks linger. Fed officials have signaled openness to rate cuts, but widening credit default swaps in AI-exposed tech stocks and concerns over Nvidia's inventory buildup have tempered enthusiasm. Bitcoin continues to track the Nasdaq closely, while crypto ETFs face persistent outflows and trade at discounts to their net asset values.

Nasdaq Seeks SEC Approval for 40-Fold Increase in Bitcoin ETF Options Trading

Nasdaq has filed with the SEC to dramatically expand options trading limits for BlackRock's spot Bitcoin ETF (IBIT). The proposal WOULD raise the current cap from 25,000 contracts to one million—a 40-fold increase that could significantly boost institutional participation in Bitcoin markets.

The move comes as Bitcoin shows signs of recovery amid uncertain institutional flows. Options contracts serve as critical risk management tools, and the current restrictions have constrained trading strategies. Approval could catalyze renewed institutional interest at a pivotal moment for crypto markets.

Market participants across the spectrum—from retail traders to hedge funds—are closely monitoring the SEC's impending decision. The regulator's response, expected in coming weeks, may reshape how traditional finance interacts with Bitcoin through regulated derivatives.

How High Will BTC Price Go?

Based on current technical indicators and market developments, Bitcoin appears positioned for potential upward movement toward the $100,000 psychological level by year-end. The technical consolidation below the 20-day moving average provides a foundation for the next leg higher, while fundamental catalysts including institutional adoption and regulatory developments support continued bullish sentiment.

| Indicator | Current Value | Interpretation |

|---|---|---|

| Current Price | $90,606 | Trading below key MA |

| 20-Day MA | $92,696 | Immediate resistance |

| Bollinger Upper | $104,390 | Near-term target |

| MACD | -885.84 | Short-term bearish |

BTCC financial analyst William suggests, 'The combination of technical consolidation and strong fundamental catalysts, including Nasdaq's proposed expansion of Bitcoin ETF options and institutional adoption, creates a compelling case for Bitcoin to challenge the $100,000 level before year-end, with potential for further gains in 2026.'